tax loss harvesting rules

Before opting for Tax Loss Harvesting the trader should be aware of the rules to set off the loss as per the Income. It is the act of booking any unrealized loss to reduce the tax outgo on your realized gain before the end of a financial year.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

1500 if married but filing separately in a given year according to IRS rules.

. Aside from that you can also consider buying crypto via an IRA Individual Retirement Account. There are rules to keep in mind while. When an asset is sold.

Crypto Taxes in 2022. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. Claim the loss on line 7 of your Form 1040 or Form 1040-SR.

To claim a loss for tax purposes. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income. If your net capital loss is more than.

For the deductible part of self-employed health insurance. The IRS enforces tax laws and rules for cryptocurrency. Turn Investment Losses Into Tax Breaks.

How Tax-Loss Harvesting Works. Crypto Taxes in 2022. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

At its most basic tax-loss harvesting involves intentionally selling poorly performing investments for a loss and reinvesting the proceeds back into the market. Tax Rules for Bitcoin and Others. Go to IRSgov.

And therefore adjusting it with the realized profits to reduce the tax liability. Tax loss harvesting. Tax-loss harvesting is a practice that takes advantage of the rules that let you use capital losses to offset other forms of taxable income.

Tax Loss Carryforward. Not all crypto activity is taxable. These gain and loss rules apply primarily to publicly traded investments such as stocks bonds mutual funds and in some cases real estate holdings.

Tax loss harvesting is an opportunistic way to bolster your post tax returns. Well discuss this strategy called tax-loss harvesting in more detail below. Advisors can comfort clients worried about market losses by showing them the benefits of tax-loss harvesting.

Tax Loss Harvesting Income Tax on Trading. Lets look at some of the non-taxable. Tax Loss Harvesting is the practice of realizing the unrealized loss through the sale of shares.

Wash sale rules prevent investors from harvesting capital losses and immediately repurchasing the same asset. Tax-loss harvesting is a common strategy for reducing capital gains taxes. If your losses outweigh your gains you can offset 3000 of income as well as take advantage of the lack of wash sale rule using tax-loss harvesting.

The capital loss carryover provisions have been incorporated to help the investors in their tax planning Tax Planning Tax planning is the process of minimizing the tax liability by making the best use of all available deductions allowances rebates thresholds and so on as permitted by income tax laws and rules imposed by a countrys government. You could owe capital gains tax from trading but mining and staking also have tax implications. Ordering tax forms instructions and publications.

As an investor if you have any short term capital gains for the year you will have to pay 15 of this as tax. Additional Rules and Changes. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part.

Tax Rules for Bitcoin and Others. Tax-loss harvesting is when you realize a capital loss on purpose so that you can use it to offset gains and income in the future. The special rules in section 172 permitting 5-year carrybacks for 2018 2019 and 2020 net operating losses NOLs added by the Coronavirus Aid Relief and Economic Security Act CARES Act of 2020 have expired.

How to Avoid Violating Wash Sale. Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total net loss shown on line 16 of Schedule D Form 1040.

Tax Loss Harvesting Beyond The Basics Tax Minimization Strategy

Reap The Benefits Of Tax Loss Harvesting

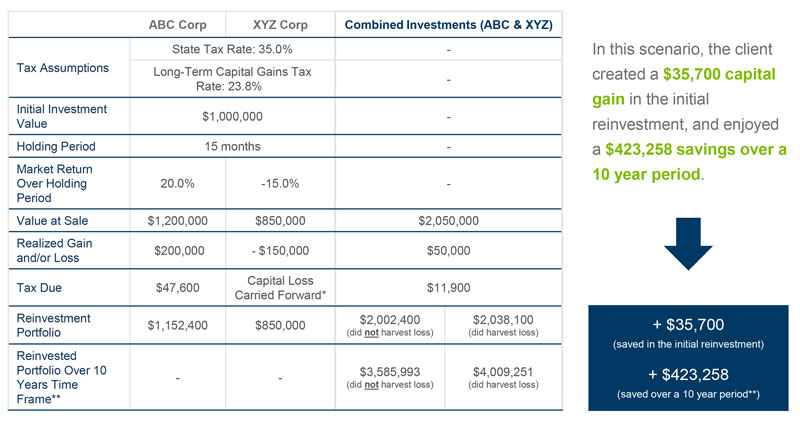

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Napkin Finance

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Upside To A Down Market Brown Advisory

Year Round Tax Loss Harvesting Benefits Onebite

Turning Losses Into Tax Advantages

What Is Tax Loss Harvesting Ticker Tape

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages